In October 2023, one of the top three credit rating agencies, S&P Global, elevated Greece’s credit rating from BB+ to BBB-, thereby giving Greece an investment-grade status. This development marked a significant vote of confidence in Greece’s economy, concluding a prolonged 13-year period during which Greece endured a suboptimal investment grade, classified as “junk status.” However, what led to Greece sustaining this status for such an extended period, and what were the root causes of the profound financial crisis that continues to leave enduring consequences on the country to this day?

Greece started being under fiscal monitoring from the European Commission in 2005, but to gain a comprehensive understanding, we must delve into the 1980s and 1990s, the pivotal decades that witnessed the accumulation of Greece’s substantial debt. The late 1970s marked a period of robust growth, known as the “Long Expansion” or the Greek economic miracle. With a GDP per capita growth rate second only to Japan at 7.51%, Greece thrived, propelled mainly by grants and loans from the Marshall Plan, and an influx of foreign investments.

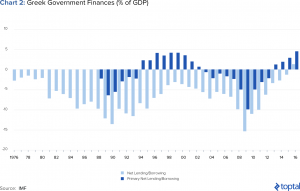

This prosperity was, however, followed by a prolonged stagnation, with GDP per capita growing at a mere average of 0.70%. Despite Greece’s accession to the European Economic Community in 1981, offering the advantages of nearly unrestricted trade among member states (most trade barriers didn’t apply between members) and a shared external trade policy, the economy faltered, with 1987’s GDP being the same as 1979’s. To a considerable extent, the situation stemmed from a political response by the Greek populace, who, having endured the ramifications of a profoundly brutal seven-year military junta, elected a government leaning towards the left and embracing social liberalism. This new political administration, among other things, engendered a substantial increase in government expenditure. This, in turn, impeded the private sector and witnessed a remarkable expansion of the public sector as a proportion of the overall GDP. Government spending and borrowing experienced a notable surge, leading to sixteen consecutive years of fiscal deficits in the double digits.

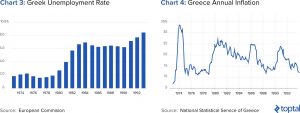

That entire era gave rise to a plethora of consequential underlying structural issues, such as an inflated public sector, excessive bureaucratic intricacies, a judicial system characterized by opacity and sluggish implementation, and an amplification of labor unions’ influence. Generally, the significant structural challenges, that are mostly still apparent to date, are concentrated in five key domains: disincentives for investment and business expansion (negatively impacting Greece’s competitiveness on the global stage), a sizable and inefficient public sector, inefficiencies within the labor market (hampering employment growth due to a lack of flexibility), inadequacies in the legal and judicial system (marked by ambiguous laws and prolonged delays), and pervasive informality (illustrated by the large proportions of economic activity that go undeclared each year). As a result, unemployment and inflation grew significantly.

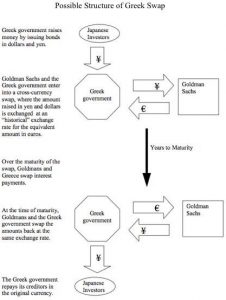

Primarily fueled by debt, imprudent and unproductive expenditures led Greece to incur borrowing costs more than twice as high as those borne by most European countries in 1992, when the Maastricht Treaty was signed. The introduction of the euro as an accounting currency in 11 EU nations in 1999 did not extend to Greece, as the country failed to meet the fiscal criteria stipulated by the EU in the Stability and Growth Pact. Specifically, to adopt the euro, a country had to maintain inflation below 1.5%, a budget deficit under 3%, and a debt-to-GDP ratio below 60%. This predicament compelled Greece to undertake specific measures to enhance its economic standing, aligning with the requirements for accessing the substantial funding and robust structure associated with Eurozone membership. Greece’s economy exhibited marginal improvement, the debt-to-GDP ratio ceased its ascent, and inflation moderated. Nevertheless, these gains proved insufficient, and despite the lingering economic fragility, Greece’s shady Eurozone join took place. Subsequent revelations disclosed that Greece had never maintained a budget deficit below 3%, and with the assistance of Goldman Sachs, significant portions of its debt were “legally” concealed through certain swaps. In 2001, Greece’s actual debt-to-GDP ratio exceeded 103%, rendering its accession to the Eurozone a clear violation of the Maastricht Treaty. This instance exemplifies accurately Greece’s economic conduct and fiscal irresponsibility at its zenith.

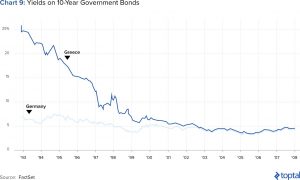

Until 2001, preceding its adoption of the Euro, Greece epitomized a fiscal landscape characterized by substantial debt-driven, unproductive expenditures that fueled a superficial economic growth devoid of a foundation in increased local production. The majority of funds were directed either towards importing goods (attributable to a glaring competitiveness gap with other Eurozone nations, which was highlighted after the euro adoption) or sustaining the expansive public sector, tailored to accommodate the clientelistic relationships between the government and its citizens. This strategy aimed at appeasing Greek voters, resulted in the creation of a swollen, inefficient, and protectionist socialist economy. Contrary to expectations, Eurozone Greece persisted in its imprudent financial practices, leveraging the enhanced financial access accompanying Eurozone membership to further underwrite unproductive spending and magnify its profound economic structural challenges. Rather than reforming its financial behavior, Eurozone Greece not only sustained but also extended it, capitalizing on the market’s unwarranted confidence following its Eurozone accession. To put market’s overconfidence in perspective, in 2003, Greece exhibited more than triple the inflation of Germany, nearly double Germany’s debt-to-GDP ratio, and an overall less healthy and structured economy, yet remarkably shared identical borrowing costs with Germany!!

This transformed Greece’s economy into a ticking time bomb on the verge of implosion. The initial indication of an impending downturn surfaced in 2004 when Greece conceded to manipulating its statistics, prompting a substantial loss of market confidence in the country. This precarious situation compelled the European Commission to subject Greece to fiscal monitoring in 2005. The catalyst for the detonation of the economic time bomb was the 2008 Global Financial Crisis, which threw the markets into disarray and rendered Greece’s substantial debt unbearable. As if that were not sufficiently adverse, in 2010, Athens, having once again acknowledged further misreporting of crucial financial data, lost access to international bond markets. Greece’s debt-to-GDP ratio surged to approximately 180%, with the budget deficit surpassing 15% of its GDP—more than four times the EU standard. During that period, negotiations for a potential bailout program with the Troika (comprising the IMF, ECB, and the European Commission) commenced, as Greece found itself devoid of alternative avenues for capital and teetering on the brink of bankruptcy. The bailout program not only served as a financial lifeline for Greece but also aimed to avert potential contagion and forestall the onset of a new global financial crisis triggered by an imminent Greek bankruptcy.

Διαβάστε επίσης:

In summary, Greece found itself in a dire financial predicament owing to decades of fiscal imprudence, leading to its entry into a bailout program in 2010. At that time, its GDP stood at 291.1 billion dollars, inflation at 4.7%, and the debt-to-GDP ratio at 136.6%. Fast forward 13 years, marked by rigorous austerity measures, three bailout agreements, and numerous reforms, Greece’s GDP has diminished to 242.3 billion dollars, the debt-to-GDP ratio has soared to 165%, and inflation hovers at 4.3%. While external factors like wars and pandemics have undoubtedly impacted Greece’s economy adversely in recent times, the financial metrics of 2019, predating these crises, paint an even bleaker picture. Despite the concerted efforts of the Troika and the Eurozone over the 2010-2018 period, Greece’s economic condition deteriorated. Was Troika’s strategy misguided and the bailout plan inefficient? Was the situation inherently irreparable or should alternative measures have been pursued? The saga from 2010 to 2018 deserves a comprehensive analysis, which will be expounded upon in a forthcoming article.

- Stagnation is a prolonged period of little or no growth in an economy often highlighted by periods of high A rate of growth of less than 2-3% annually as measured by GDP is considered stagnation

Author: Άγγελος Λαγός