As we approach the conclusion of the third quarter of 2023, it becomes imperative to assess the current state of the global economy, with a particular focus on the ongoing battle against inflation. This global outlook will be examined through the prism of the world’s foremost financial communities, primarily the United States and the European Union. Additionally, a brief analysis of Greece’s economic landscape will be conducted to draw comparisons with these larger economies.

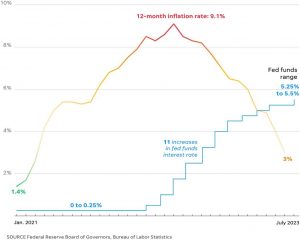

Commencing with the United States, the latest report as of June 2023 indicates a notable reduction in the annual inflation rate, which has fallen from 4% in May to a level of 3%. This marks the lowest inflation rate observed since March 2021. The decrease in inflation can primarily be attributed to declining energy and economic prices, a trend mirrored in Core Inflation—an index that excludes the volatile prices of energy and food—where it stood at 4.8%, considerably higher than the standard 3% inflation rate. The significant discrepancy between core inflation and the Federal Reserve’s target of 2%, compounded by the standard inflation rate remaining above the desired threshold, prompted the Federal Reserve to raise interest rates to an unprecedented 22-year high of 5.5%.

Moreover, consumer spending in current dollars in the United States witnessed a robust increase of 0.8% in July 2023, marking the most substantial uptick since January and surpassing market expectations of a 0.7% upswing. This surge underscores the resilience of the U.S. consumer amid a decelerating economy. Notably, spending exhibited a substantial rise in chained dollars (dollars adjusted for inflation), at 0.6%, signifying the consumer’s ability to withstand inflationary pressures. This, in turn, suggests that the Federal Reserve retains room for additional financial tightening. The objective is to temper the economy’s pace sufficiently to curtail elevated inflation to the desired 2% level without precipitating a severe recession.

However, it is essential to acknowledge that the recent surge in spending may not be sustainable, as it largely relies on savings rather than increased income. Specifically, personal income experienced a modest 0.2% increase in July, slightly below the anticipated 0.3%, while the savings rate dwindled from 4.3% in June to 3.5%. A portion of this decline in July can be attributed to elevated taxes, thereby reducing disposable income by 0.2%. This presents a less robust outlook for consumer spending.

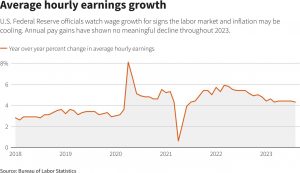

Furthermore, a pivotal aspect of the Federal Reserve’s strategy to combat inflation entails slowing the rate of job and wage growth. An abundance of job openings places immense pressure on the labor market, leading to higher wages, escalating costs, and subsequently, inflation. According to many economists, the ideal wage growth rate to maintain a 2% inflation rate is 3.5%. While August witnessed the smallest wage increase since February 2022, at a mere 0.2%, the annual wage growth remains at a significant 4.4%, considerably above the targeted 3.5%.

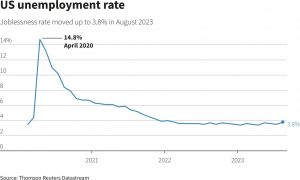

The imperative of slower job and wage growth needs to be balanced with the unemployment rate, which, if significantly elevated, could precipitate a devastating recession. The rise in the unemployment rate to 3.8% in July, coupled with job openings falling to their lowest level in nearly 2.5 years, is not cause for undue concern, given the concurrent decline in initial applications for unemployment benefits. This suggests a necessary moderation in the labor market without placing excessive stress on the overall economy.

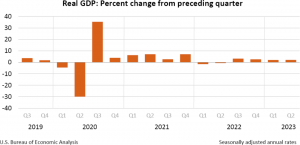

Lastly, real gross domestic product (GDP adjusted for inflation), registered an annualized growth rate of 2.1% in the second quarter of 2023, an improvement from the 2% growth observed in the first quarter of the same year. Projections from JP Morgan anticipate a 2.5% increase in real GDP for the third quarter.

In summary, the prevailing economic conditions in the United States, marked by reduced inflation, increased consumer spending, moderation in labor and wage markets, and growing GDP, outweigh the relatively negative indicators, such as the unemployment rate, savings rate, and core inflation. These factors lead us to believe that a recession is likely to be averted in the foreseeable future (within the next six months), while the economy continues to tighten at a desirable pace. This also suggests that the Federal Reserve is unlikely to raise interest rates at its upcoming mid-September meeting, with a probable adjustment expected towards the end of 2023.

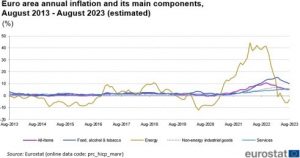

Moving on to the European Union, another influential financial community shaping the global economic landscape, it grapples with similar financial challenges in the post-pandemic era, with high inflation being a primary concern. In particular, August witnessed no change in inflation, which remains at 5.3%, while core inflation declined marginally from 5.5% to 5.3%. The unemployment rate has held steady at 6.4%, and European business activity has once again contracted, reaching its lowest point since November 2020. In line with the analysis of the U.S. economy, European consumer spending experienced a decline in the first quarter of 2023, and the real GDP of eurozone members increased by a modest 0.3% in the second quarter of 2023.

Concerns stemming from significantly higher inflation and unemployment rates in the EU compared to the U.S. are somewhat offset by other metrics within the eurozone, such as the savings rate, which rose from 12.65% in the fourth quarter of 2022 to 13.34% in the first quarter of 2023. Despite persistently high inflation, the stagnant employment situation and reduced consumer spending may deter the European Central Bank (ECB) from raising interest rates from their current level of 3.75% in September. Notably, the eurozone’s distinctive characteristic lies in the disparate economic conditions of its member states. For instance, in the second quarter, Germany’s economy stagnated, Italy’s contracted, and Spain’s expanded. This diversity presents significant challenges in formulating a unified monetary policy for the union.

Within the European Union, Greece stands as one of its diverse economies. A brief overview of the latest economic data pertaining to Greece reveals substantial improvements. Real GDP exhibited robust growth, expanding by 6% in 2022, while the unemployment rate decreased from 11.8% in 2022 to 11.2% in April 2023. Additionally, despite a steady increase in nominal Public Debt, the debt-to-GDP ratio is on a consistent downward trajectory, decreasing from 194.6% in 2021 to 171.3% in 2022, a positive trend for the Greek economy. Furthermore, despite the balance of payments recording a negative value, shifting from -7.65% in 2021 to – 8.70% in 2022, the 10-year Bond Yield exhibited a notable decline from 4.22% in 2022 to 3.70% in 2023. This reduction is due to investors considering Greece’s return to investment-grade credit ratings “a done deal”.

In conclusion, this report has provided an overview of the current economic status of major Western economic communities, and Greece. While it would be beneficiary to analyze China’s current economic landscape, as the world’s second-largest economy, this topic warrants a separate article due to its distinct circumstances. Notably, China grapples with deflation, rather than high inflation, and faces the looming specter of a significant housing market collapse. Fortunately, Western economies are in a more favorable position than China, but they are still walking a tightrope between high inflation-cost of living and a recession. Whether we will manage to have a much-wished soft landing is up to be seen in the foreseeable future.

Author: Άγγελος Λαγός